Have you ever been asked to provide a cancelled cheque while applying for a loan or a bank account or a credit card? If yes, then you may be wondering what it is all about. Why don’t you go through this short post and know more? Read on!

What is cancelled cheque?

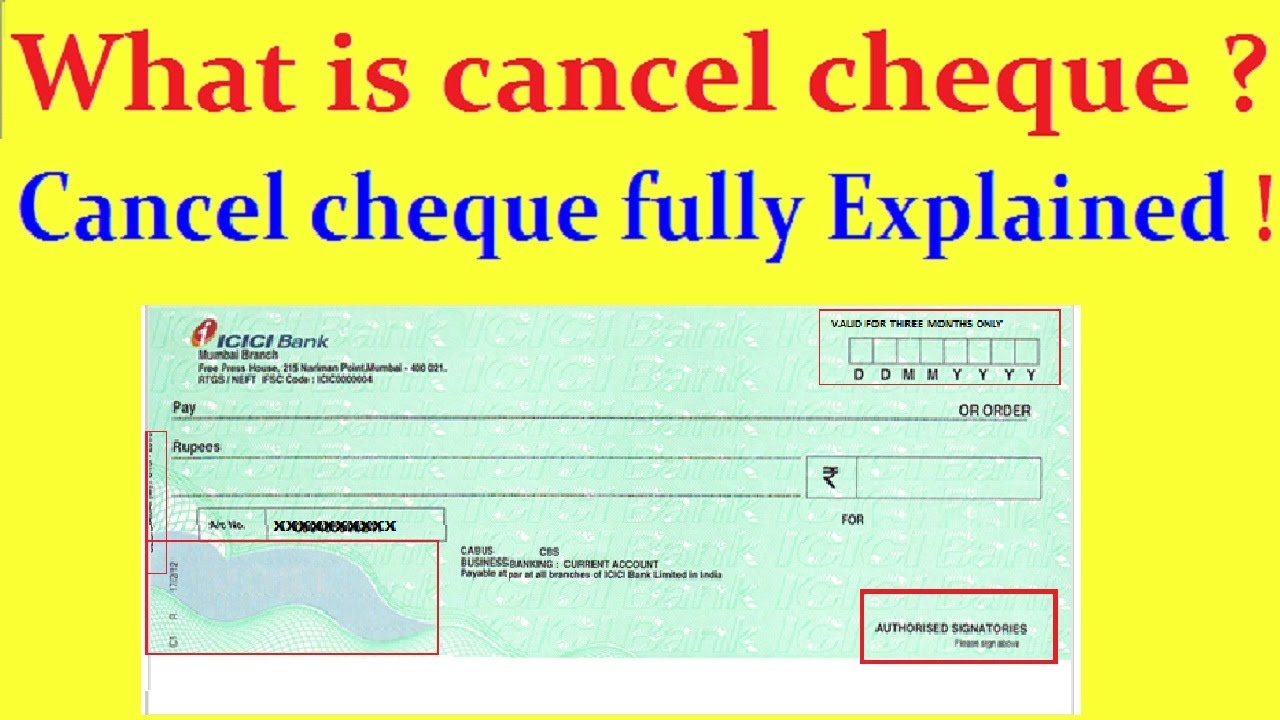

Don’t have any idea about what is cancelled cheque ? A canceled cheque in India denotes any cheque that has been canceled by writing the word ‘canceled’ across it by drawing two parallel lines. A canceled cheque is a proof that you are actually the owner of the account in a bank. Cancelled cheque is basically needed for Know Your Customer (KYC) purposes to provide your services.

The cancelled cheque may also be required to facilitate many financial services from EPF funds withdrawal to ECS set up from an account to buy products on EMIs.

How is a cancelled cheque issued?

While issuing a cancelled cheque, all that you need to do is take a cheque leaf out of your checkbook and write the word ‘Cancelled’ in either capital or sentence case. You can use blue or black ink to do that. You can draw two lines parallel and write ‘Cancelled’ diagonally in between those two lines.

While making a cancelled cheque, you are not needed to sign it as it does not have any monetary value. It means that the cancelled cheque can’t be used to send or receive money.

A cancelled cheque has all bank information such as bank name, account number, account holder name, branch address of the bank, IFSC Code, and MICR Code.

Although no one can withdraw or send any amount using a cancelled cheque, you should be careful not to sign it as some instances of fraud have occurred in the past.

Thus, be very sure to whom you are issuing it and not to any stranger or someone you don’t believe at all.

What are the uses of a cancelled cheque?

- In most of the cases, a canceled cheque is needed to complete KYC formalities while availing many services. From investing in a Mutual Fund or the stock market to setting up ECS debit or buying products on EMIs, the service provider asks for it. It is done to verify your bank account details that it belongs to you only.

- EMIs have become one of the modes of payment these days. From laptops to smartphones to TV and for different loans like personal, car, education loans, people prefer paying in EMIs. It is done to manage monthly outlays. Hence, to facility EMI payment procedures, you may be asked to submit a canceled cheque.

- A canceled cheque is a must to set up to deduct a certain amount for a specific period from your bank account automatically.

- When you want to withdraw your provident fund money, companies may ask you to submit a canceled cheque. It is done to ensure that the money is credited into a correct bank account that you hold.

- Even if you were looking to buy an insurance policy in the future, then you may need to submit a canceled cheque to facilitate the opening formalities.

You can get your chequebook from your bank branch or get it delivered to your communication address easily. You are now aware of the basics of the canceled cheque, how to issue one, and its vital uses.

Read Also: Times Interest Earned Ratio

The only thing while issuing someone a canceled cheque is that you should not sign it. Even if you need to do that, you must get in writing the reason from the person in the letterhead of the company for future references.