Investment Banking Analyst

Investment banking analysts, also known as security analysts, were earning an annual salary of at least $100,000 including bonuses, according to Careers in Finance. Investment banking analysts research investments for fund managers, so decisions can be made on portfolios that the bank manages.

To be an analyst, you need a bachelor’s degree in finance or economics. Working in the investment banking industry is a stressful job that requires precise detail. You must be prepared to work long hours that usually go beyond 40 hours every week.

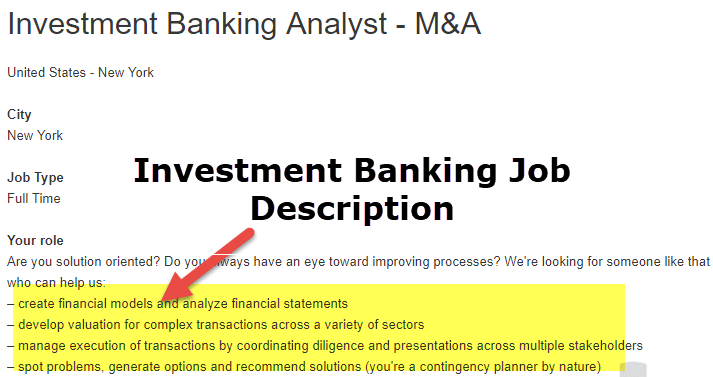

Role Of An Investment Banking Analyst

Investment bankers are responsible for a wide range of duties including raising capital, providing advisory services for mergers and acquisitions (M&A) and other corporate transactions, completing valuation work, and marketing the value of the banks’ expertise to client companies.

How to Become an Investment Banking Analyst

Investment banking analysts influence financial decisions and can determine in which companies their clients should invest. This article looks at the typical duties they perform and the job prospects and income expectations for this career.

Investment banking analysts help their clients develop and maintain effective investments that will meet their goals. One of their initial tasks is to assess the needs of the client. They clarify their goals and then research potential investment opportunities. If the client already has investments, they assess those investments to determine which ones are performing well and what investments they should consider replacing.

These analysts will investigate other investment options and make recommendations to clients about potential investments. They may also concentrate on evaluating investment possibilities on behalf of their institution. In this capacity, the investment banking analyst will scrutinize businesses within an industry.

How much do investment banking analysts make?

Investment Banking Analyst Salary

They will consider things such as business Assets, earnings reports, and industry-related variables to determine whether or not they recommend investing in a company. It’s common for investment banking analysts to specialize in a specific field, such as healthcare, and focus on companies that are in that industry. Once they have gathered and processed sufficient data, they produce their conclusions. They regularly present information to clients or to other professionals in their bank.

What To Look For In A Job Interview Of An Investment Banking Analyst

Bank analyst candidates should be prepared to tout their experiences, either in their academic studies or in their careers. Be prepared to discuss your analytical and problem-solving skills. Interviewers will also likely ask you to define and elaborate on your interpersonal skills, your work ethic (those 80-hour weeks may or may not come up, but prepare like they will, and have a good response ready).

Investment firms will give an edge to candidates who can speak multiple languages (Chinese, Spanish, and German are highly favored these days), and to candidates who have a firm grasp on technology and social media.

When you do get to the negotiating table, know that the average entry-level annual salary for investment analysts is $62,645, while financial analysts usually command $54,488 right out of the gate. Additional compensation, such as signing bonuses or yearly performance-based bonuses, is usually available, but these payouts will vary greatly depending on the employer.

Read Also: Double Declining Balance Depreciation

A bonus tip: while you can launch your banking analyst job search on any date on the calendar, Wall Street firms usually deliver their yearly bonuses in December, after which some analysts may decide to jump ship. Thus, start your search in November, and intensify it in December and January, just as hiring managers are looking to make a move.

If you’re a college graduate looking to break in, Wall Street firms often provide job fairs, “Super Saturdays” (recruiting events held on Saturday at the financial institution) and networking socials to break the ice – usually in the spring months. Check with your college jobs and careers office for details.