Statement Of Retained Earnings: The statement of earnings (earnings statement) is an economic statement that outlines the development in earnings for a company over a specified period. This announcement reconciles the beginning and ending earnings for the period, using information such as net salary from the other financial statements, and is used by analysts to understand how corporate profits are utilized.

The announcement of receive earnings is also known as an of owner’s equity, an equity announcement, or a statement of shareholders’ equity. Boilerplate templates of the statement of retained earnings can be found online. It is prepared in accordance with generally accepted bookkeeping principles (Gap).

Statement Of Retained Earnings Example

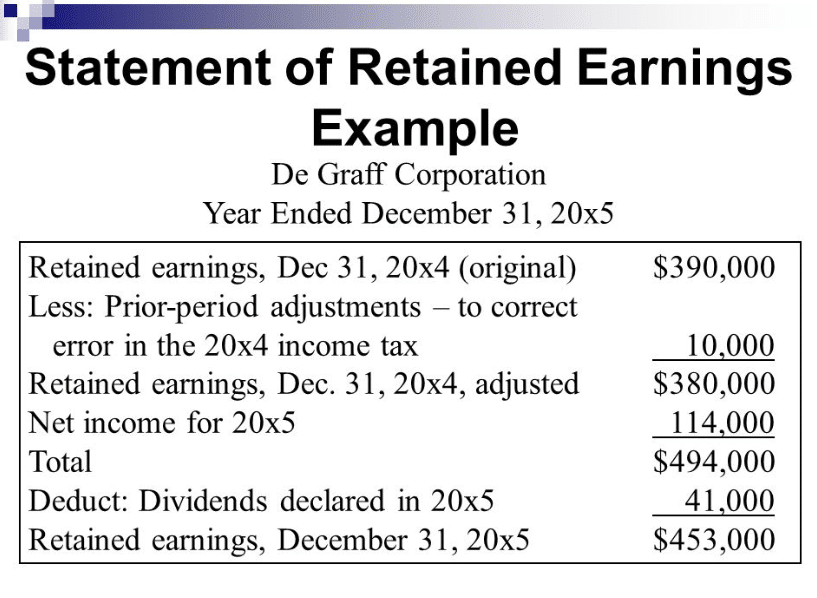

The statement of receive earnings reconciles changes in receive earnings accounts during a reporting period. The statement begins with the beginning tension in receive earnings account, and then adds or subtracts such items as profits and dividend restitutions to arrive at the ending receive earnings balance. The general calculation structure of the announcement is:

Beginning retained earnings + Net income – Dividends = Ending retained earnings

The statement of earnings is most commonly presented as a separate statement, but can also be appended to the bottom of another financial statement.

Example of the Statement of Retained Earnings

The following example shows the most simplified version of a statement of earnings:

Arnold Construction Company

Statement of Retained Earnings

for the year ended 12/31×2

| Retained earnings at December 31, 20X1 | $150,000 |

| Net income for the year ended December 31, 20X2 | 40,000 |

| Dividends paid to shareholders | -25,000 |

| Retained earnings at December 31, 20X2 | $165,000 |

It is also probable to provide a greatly enlarged version of the announcement of earnings that acknowledges the various elements of retained earnings. For example, it could separately identify the par value of the commonplace stock, additional paid-in capital, receive earnings, and treasury stock, with all of these fundamentals then rolling up into the totals just noted in the last example. Here is a sample of a more expanded announcement of earnings:

Arnold Construction Company

Statement of Retained Earnings

for the year ended 12/31×2

| Common Stock, $1 Par |

Additional Paid-In Capital |

Retained Earnings |

Total Shareholders’ Equity |

|

| Retained earnings at December 31, 20X1 | $10,000 | $40,000 | $100,000 | $150,000 |

| Net income for the year ended December 31, 20X2 | 40,000 | 40,000 | ||

| Dividends paid to shareholders | -25,000 | -25,000 | ||

| Retained earnings at December 31, 20X2 | $10,000 | $40,000 | $115,000 | $165,000 |

The statement is most commonly used when issuing financial statements to entities outside of a business, such as investors and lenders. When financial statements are developed strictly for internal use, this statement is usually not included, on the grounds that it is not needed from an operational perspective.

Statement Of Retained Earnings Definition

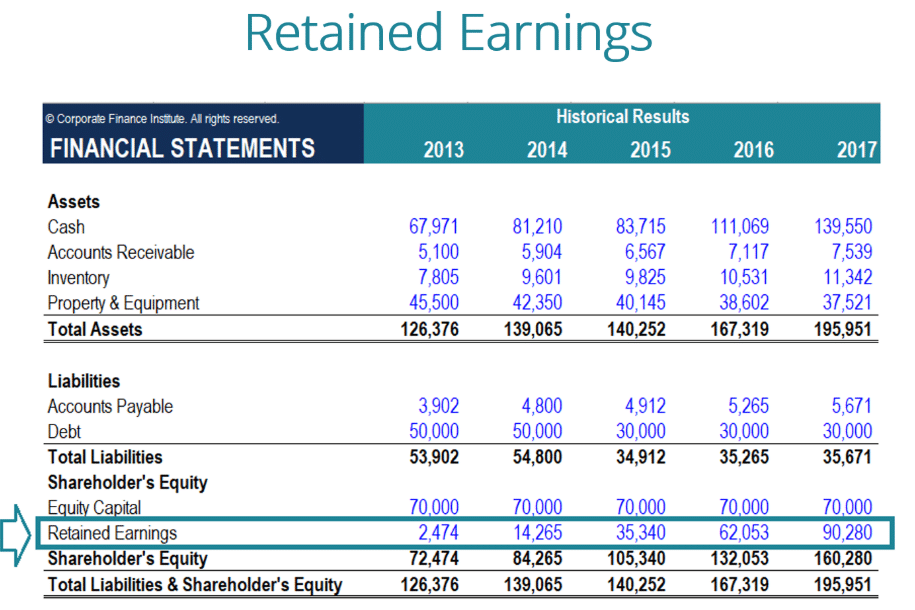

After a successful earnings period, a company, can (at the discretion of its board of directors) pay some of its income to shareholders, as dividends, and keep the remainder as retained earnings. These add to the firm’s accumulated retained earnings, which appear on the Balance Sheet under Owners Equity.

The Statement of Retained Earnings

After each reporting period, firms publish a Statement of retained earnings. This statement shows:

- Firstly, how net income from the current period adds retained earnings to the firm’s total retained earnings. This total appears on both the Balance sheet and the Statement of retained earnings.

- Secondly, the portions of the period’s Net income the firm pays as dividends to owners of preferred and common stock shares.

Not incidentally, that “Retained earnings” is one of the four primary financial statements that public companies must publish quarterly and annually. The other three are the Income statement, Balance sheet, and Statement of changes in financial position SCFP.

Who Uses the Statement of Retained Earnings?

“Retained earnings” is usually the briefest of the mandatory statements, often just a few lines. The short example in Exhibit 1, below, is typical. However, for investors and shareholders, Retained earnings are arguably the most important of the four. It is crucial because Investors hope that stock ownership will reward them either from dividends, or from increases in stock share price, or both.

- Investors regard some mature, established firms, as reliable sources of dividend income.

- When firms are undergoing rapid growth and expansion, by contrast, they typically bypass dividend payments entirely and direct all income into earnings. Here, investors hope to benefit from rising share prices.

Investors will, therefore, look to a firm’s current and previous earnings statements:

- Firstly, to predict future dividend performance.

- Secondly, as one of several factors to consider for predicting future share price growth

Explaining Retained Earnings Statement in Context

This article further defines, describes, and illustrates Earnings in context with related accounting concepts, focusing on four themes:

- First, sources of Earnings.

- Second, for example, Statement of Earnings.

- Third, Earnings impact on other financial statements.

- Fourth, sources of Published Retained earnings figures for Public companies.

Statement Of Retained Earnings

The purpose of retaining these earnings can be varied and includes buying new equipment and machines, spending on research and development, or other activities that could potentially generate growth for the company. This reinvestment into the company aims to achieve even more earnings in the future.

If a company does not believe it can earn a sufficient return on investment from those earnings (i.e., earn more than their cost of capital), then they will often distribute those earnings to shareholders as dividends or share buybacks.

At the end of each accounting period, earnings are reported on the balance sheet as the accumulated income from the prior year (including the current year’s income), minus dividends paid to shareholders. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance.

The RE balance may not always be a positive number, as it may reflect that the current period’s net loss is greater than that of the RE beginning balance. Alternatively, a large distribution of dividends that exceed the retained earnings balance can cause it to go negative.

Read Also: Times Interest Earned Ratio

Any changes or movement with net income will directly impact the RE balance. Factors such as an increase or decrease in net income and incurrence of net loss will pave the way to either business profitability or deficit. The Retained Earnings account can be negative due to large, cumulative net losses. Naturally, the same items that affect net income affect RE.

Examples of these items include sales revenue, cost of goods sold, depreciation, and other operating expenses. Non-cash items such as write-downs or impairments and stock-based compensation also affect the account.

Statement Of Retained Earnings Formula

The statement of earnings is a financial statement that summarizes the changes in the number of earnings during a particular period of time.

earnings is the portion of net income that a company does not distribute among its shareholders but retains in the business for various purposes such as the growth of business in the future and meeting the debt obligations etc. It increases when the company earns net income and decreases when a company incurs net loss or declares dividends during the period. earnings appear in the balance sheet as a component of stockholders’ equity.

Notice that the statement of earnings starts with the beginning balance of earnings. The resulting figure is the earnings at the end of the period that appears in the stockholders’ equity section of the balance sheet at the end of the period.