Times Interest Earned Ratio

Times Interest Earned Ratio: The time’s importance earned (TIE) ratio is a quota of a company’s strength to meet its debt obligations based on its modern income. The formula for a company’s TIE number is earnings since interest and taxes (EBIT) partitioned by the total importance payable on bonds and other debt.

The time’s interest earned ratio, sometimes called the importance coverage ratio, is a coverage ratio that computes the proportionate amount of compensation that can be used to cover interest expenses in the future.

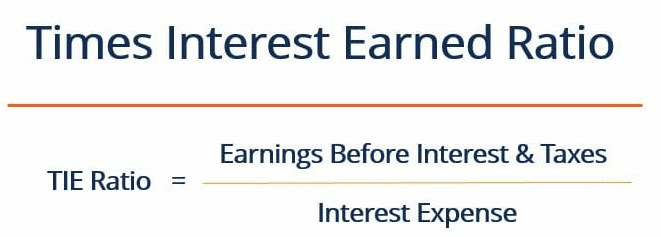

Times Interest Earned Ratio Formula

The time importance earned ratio is a gauge of a corporation’s strength to meet the interest restitutions on its debt. The time’s interest earned ratio is calculated as follows: the corporation’s income before interest investment and income tax investment divided by its importance expense.

In some respects, the time’s interest ratio is considered a solvency ratio because it averages a firm’s ability to make interest and debt service restitutions. Since these interest payments are customarily made on a long-term basis, they are often treated as an ongoing, fixed expense. As with most fixed expenses, if the corporation can’t make the payments, it could go insolvent and cease to exist.

Thus, this ratio could be considered a richness ratio. The larger the time’s interest earned proportion, the more likely that the company can make its interest restitutions. The time’s interest earned ratio is also referred to as the import coverage ratio.

Example of Times Interest Earned Ratio

Assume that a corporation had the following amounts for the most recent year:

- Net income after tax of $500,000

- Interest expense of $200,000

- Income tax expense of $300,000

Given these assumptions, the corporation’s income before interest and income tax expense was $1,000,000 (net income of $500,000 + interest expense of $200,000 + income tax expense of $300,000). Since the interest expense was $200,000, the corporation’s times interest earned ratio was 5 ($1,000,000 divided by $200,000).

The Times Interest Earned Ratio Is Computed As

The time’s interest earned ratio quotas the ability of an organization to pay its debt obligations. The ratio is frequently used by bankers to ascertain whether an expected borrower can afford to take on any supplementary debt. The ratio is calculated by comparing the earnings of a corporation that is available for use in paying down the interest investment on debt, divided by the amount of prosperity expense. The formula is:

Earnings before interest and taxes ÷ Interest expense = Times interest earned

For example, a business has a net income of $100,000, income taxes of $20,000, and interest expense of $40,000. Based on this information, its time’s interest earned ratio is 4:1, which is calculated as:

($100,000 Net income + $20,000 Income taxes + $40,000 Interest expense) ÷ $40,000 Interest expense

A ratio of less than one indicates that a business may not be in a position to pay its interest obligations, and so is more likely to default on its debt; a low ratio is also a strong indicator of impending bankruptcy. A much higher ratio is a strong indicator that the ability to service debt is not a problem for a borrower.

There are a number of flaws associated with this ratio, which are:

- The EBIT figure noted in the numerator of the creed is a bookkeeping calculation that does not unquestionably relate to the amount of cash spawned. Thus, the ratio could be excellent, but employment may not actually have any cash with which to pay its importance charges. The reverse position can also be true, where the scale is quite low, even nevertheless a borrower actually has significant positive cash flows.

- The amount of interest expense materializing in the denominator of the creed is an accounting prediction that may incorporate a discount or premium on the sale of bonds, and so does not equate to the actual amount of interest expense that must be paid. In these cases, it is better to use the interest rate stated on the face of the bonds.

- The ratio does not take an explanation of any looming outstanding paydown, which could be large enough to bring about the bankruptcy of the borrower, or at infinitesimalest force it to refinance at a higher rate of importance, and with more severe loan covenants than it currently has. Also, a variation on the time’s interest brought in the ratio is to also deduct reduction and amortization from the EBIT figure in the numerator.

- However, depreciation and amortization secondhand relate to a business’s need to buy fixed assets and ethereal assets on a long-term basis, and so may not suggest funds that are available for the settlement of interest insurance.

Times-interest-earned Ratio

The times interest earned (TIE) ratio, sometimes called the interest coverage ratio or fixed-charge coverage is another debt ratio that measures the long-term solvency of a business. It measures the proportionate amount of income that can be used to meet interest and debt service expenses (e.g., bonds and contractual debt) now and in the future. It is commonly used to determine whether a prospective borrower can afford to take on any additional debt.

For example, if a company owes interest on its long-term loans or mortgages, the TIE can measure how easily the company can come up with the money to pay the interest on that debt.

In some respects, the times interest earned ratio is considered a solvency ratio. Since interest and debt service payments are usually made on a long-term basis, they are often treated as an ongoing, fixed expense. As with most fixed expenses, if the company is unable to make the payments, it could go bankrupt, terminating operations. Thus, this ratio could be considered a solvency ratio.

Calculation

The times interest earned ratio is calculated by dividing the income before interest and taxes (EBIT) figure from the income statement by the interest expense (I) also from the income statement.

Times interest earned ratio = EBIT or Income before Interest & Taxes / Interest Expense

The times interest earned ratio is stated in numbers as opposed to a percentage, with the number indicating how many times a company could pay the interest with its before-tax income. As a result, larger ratios are considered more favorable than smaller ones. For instance, if the ratio is 4, the company has enough income to pay its interest expense 4 times over. Said differently, the company’s income is four times higher than its yearly interest expense.

The higher the number, the better the firm can pay its interest expense or debt service. If the TIE is less than 1.0, then the firm cannot meet its total interest expense on its debt. However, a high ratio can also indicate that a company has an undesirable or insufficient amount of debt or is paying down too much debt with earnings that could be used for other projects.

Times Interest Earned Ratio Calculator

Joe’s Excellent Computer Repair is applying for a loan, and the bank wants to see the company’s financial statements as part of the application process. As a part of the qualification process, creditors (e.g., banks and other lending institutions) assess the likelihood that the borrower will be able to repay the loan, principal, and interest. Using the times interest earned ratio is one indicator that the company can or cannot fulfill the obligation. The statement shows $50,000 in income before interest expenses and taxes.

The company’s overall interest and debt service for the year amounted to $5,000; therefore, the calculation would be:

Thus, Joe’s Excellent Computer Repair has a times interest earned ratio of 10, which means that the company’s income is 10 times greater than its annual interest expense, and the company can afford the interest expense on this new loan. In this respect, Joe’s Excellent Computer Repair doesn’t present excessive risk, and the bank will likely accept the loan application.